Whats up Buddies,

As it’s possible you’ll remember, DGFT has reclassified the import of laptops, tablets, all-in-one private computer systems, ultra-small kind issue computer systems, and servers falling underneath HSN 8741 from “Free” to “Restricted” class. This transfer has been undertaken to advertise home manufacturing.

Because of this now the import of those merchandise into India would require a “Restricted Import License,” which might be issued by the DGFT Headquarters in New Delhi.

Initially, DGFT had introduced this modification to take fast impact, however after vital chaos, it has now been determined to implement it from November 1, 2023. This suggests that any imports cleared earlier than October 31 is not going to require an import license, however shipments arriving from November 1 onwards might want to apply for a Restricted Import License compulsorily.

Exemptions Offered

The next exemptions have been supplied for imports:

- Imports of just one unit of laptops, tablets, PCs, and many others., by means of publish or courier are exempted from the requirement of a license.

- Exemption can be granted for the import of as much as 20 such objects per consignment for functions similar to analysis and growth (R&D), testing, benchmarking, analysis, restore and re-export, and product growth. Import and not using a license is on the market just for these specified functions, with the situation that after the aim is fulfilled, the agency should both destroy the product or re-export it.

- If a product is shipped overseas for restore after which re-imported, it is not going to require a license.

- Moreover, if laptops, tablets, PCs, and many others., function important components of capital items, they’re additionally permitted for import and not using a license.

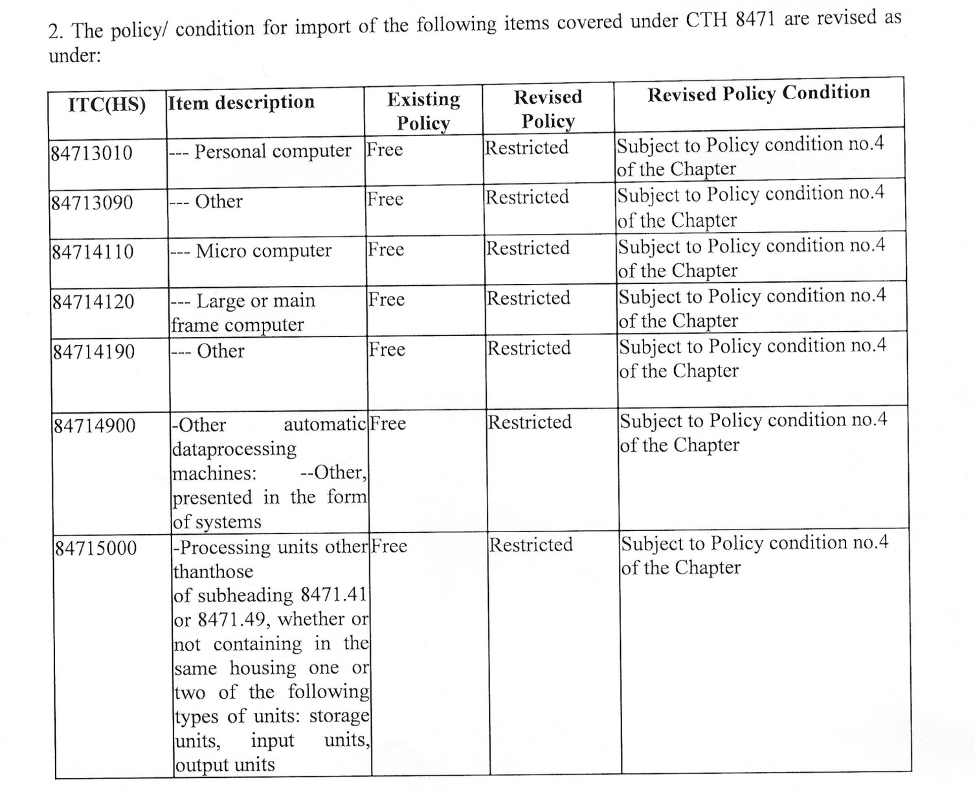

Please check with the picture for a listing of merchandise with their 8-digit HSN codes to which these new situations will apply.

Extra Exemptions as per Newest Notification

DGFT has issued some further exemption standards in its newest notification No. 38 dated October 19, 2023:

- Objects manufactured inside Particular Financial Zones (SEZ) will be freely imported into the Home Tariff Space (DTA) with out the necessity for a Restricted Import authorization. Nonetheless, actions similar to re-packing, labeling, refurbishing, testing, and calibration is not going to be thought of as manufacturing actions inside SEZs.

- Non-public entities supplying to the Central or State Governments for protection or safety functions are additionally exempted from procuring a restricted import license.

- Exemption is granted for the restore, return, or substitute of IT {hardware} beforehand offered, in addition to for the re-import of such objects repaired overseas, on a self-certification foundation.

- SEZ items, in addition to items working underneath the Export Oriented Models (EOU), Software program Expertise Parks of India (STPI), Digital {Hardware} Expertise Parks (EHTP), and Biotechnology Parks (BTP), are additionally exempted from import licensing necessities, supplied that the import is solely for captive consumption of the items.

- Import of spares, components, assemblies, sub-assemblies, and parts related to IT {hardware} units can be exempted from the requirement of a license.

Watch the under video in HINDI which explains the brand new course of to import Laptops, Tablets, Private Computer systems, Servers and many others. into India. It will provide you with an thought in regards to the Paperwork required, timeframe, exemptions supplied and many others.

Utility Course of and Paperwork required

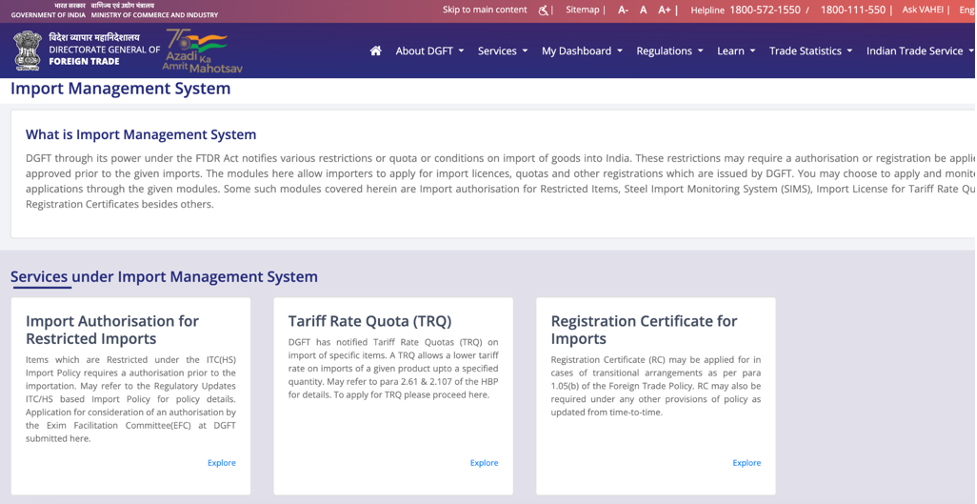

As per the newest Round No. 06 dated October 19, 2023, the Directorate Normal of Overseas Commerce (DGFT) has launched the Import Administration System for the import of IT {hardware}.

To provoke the appliance course of, candidates are required to use on-line on the DGFT web site. In accordance with the supplied picture, the candidates want to pick out “Import Authorization for Restricted Imports” underneath the Import Administration System to start the appliance course of.

When submitting the appliance, that you must present some primary particulars:

- Choose the merchandise of import and point out whether or not it’s refurbished or not.

- Specify the nation of origin, amount, and CIF worth of the imported merchandise.

- Present particulars of things imported underneath license within the final 3 licensing years.

- Point out the gross sales/turnover particulars for the previous 3 years.

- Choose the port of import and function of import, similar to for precise use or buying and selling functions.

It is essential to notice that importers can apply for a number of authorizations, and all authorizations might be legitimate till September 30, 2024. You may modify the amount of things in your authorization at any given time, however the general CIF worth can’t be modified.

[If You are an Importer and have still not applied for EPR Registration and are confused whether your Company requires it or not, Please check our blog on this, which also explains the entire process of Registration on CPCB Portal – Who needs EPR registration and What is the Process?]

At Afleo Group, we specialise in acquiring Restricted Import Licenses from DGFT, and we will help you all through the documentation course of and liaison work. Please do not hesitate to achieve out to us for any of your necessities. When you have any doubts or questions, be happy to remark, and our workforce might be completely satisfied to help you.

Thanks.

Have any doubts? Please fill the shape under to get in contact with us.

Our presence on Youtube