The primary quarter of 2024 introduced with it much more spectacular positive aspects serving to to push the S&P 500 (SPY) to new heights. That’s then…that is now. That means that there’s good cause to consider the tempo of positive aspects will gradual tremendously. Gladly 44 yr funding veteran Steve Reitmeister shares his up to date market outlook together with buying and selling plan and prime picks to outperform the remainder of the yr. Get the total story under.

It was practically inconceivable to lose cash in Q1 given a hearty 10% acquire for the S&P 500 (SPY). Much more spectacular was the 25% acquire in the event you roll the clock again to the beginning of November 2023.

If you understand that the common annual acquire for shares is just 8%, you then admire that these good occasions usually are not going to final.

No…that doesn’t imply a bear market on the best way. Simply that the tempo of those positive aspects ought to gradual dramatically from right here.

Our objective on this commentary in the present day is to recap the important thing particulars from Q1 within the hopes it lights a path to superior returns within the months forward.

Market Commentary

All through 2023, and into early 2024, the inventory market has been a bit lopsided. That being the place an excessive amount of of the positive aspects have accrued to the mega cap tech shares with smaller inexperienced arrows subsequent to most different teams.

Thus, the next chart of Q1 efficiency by market cap won’t come as a shock to you:

As soon as once more, we see that smaller shares are lagging on the yr (small, micro and nano). As shared with you fairly just a few occasions prior to now, small shares have a marked historic benefit over lengthy caps going again 100 years. So, the 4 yr benefit for giant caps is a little bit of an anomaly.

In some ways, small caps main a bull market is the healthiest signal because it says that traders are in a danger taking temper. Whereas loading up on the identical 7 mega cap tech shares to me feels a bit like including blocks to a tower within the sport of Jenga. It really works for some time, then turns into too tall and unstable resulting in an eventual fall. Extra about what which means within the outlook part additional under.

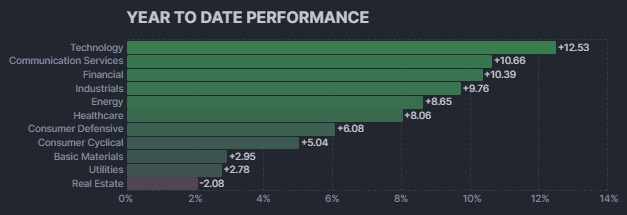

Now let’s verify in with the 2024 efficiency by sector:

That is pretty nicely a repeat of 2023 with Expertise and Communication Providers main the best way. Whereas extra defensive teams (Client Defensive, Utilities, Healthcare) are center to backside of the pack.

That is pretty typical for a bull market as Expertise and Communication Providers are 2 of the higher development oriented teams. The extra stunning half is the weak point in Fundamental Supplies and Industrials which is normally a robust performer within the early levels of a brand new bull market.

OK…that is what occurred as we’re solely 18 months into a brand new bull market. And provided that they sometimes final over 5 years there may be good cause for optimism that extra upside lies forward. But as foreshadowed within the intro…the tempo of positive aspects ought to gradual dramatically from right here.

Market Outlook & Buying and selling Plan

I lately shared a way more full presentation on my inventory market outlook for the remainder of 2024 together with a buying and selling plan and prime picks to outperform. Watch It Here >

The abstract model is that the straightforward positive aspects have been made with a roughly 50% acquire in simply 18 months. That’s as a result of traders are doing their typical job of studying forward within the playbook.

For that I imply that traders are nicely conscious that the Fed can be decreasing charges someday this yr which can be a catalyst for increased financial development. So they’re bidding up shares prematurely of that motion. That additionally opens the door for a reasonably tepid response to the precise decreasing of charges which is true now wanting most just like the June 12th Fed assembly.

Lengthy story brief, I think that the highest for the S&P 500 this yr can be about 5,500. A modest 5-6% enhance from present ranges. However extra on par with the form of real looking annual positive aspects it’s best to anticipate as we transfer ahead.

Sure, I do know that doesn’t sound too thrilling for traders simply hitching a experience in the marketplace indices. Gladly I do see a path to vastly superior outcomes in the event you admire these superior inventory choice standards.

Firstly, the 4 yr benefit for giant caps ought to come to an finish. I consider that small caps might simply outperform by 2-3X over the S&P 500 over the subsequent couple years.

Second, fundamental supplies and industrials ought to outperform as decrease charges additionally lowers their price construction (largely due to decreasing borrowing prices) resulting in increased revenue margins. This concept additionally factors the best way to put money into different industries that profit from decrease charges; housing, autos, banks, bonds and even earnings shares (as bond charges go decrease, the dividend yield on earnings shares turns into extra enticing serving to to push up their worth).

Lastly, we’re transferring previous the section the place development is heart stage for inventory choice. Going ahead, the common shares is fairly totally valued…and lots of the massive caps are clearly over valued. This may push traders to hunt undervalued shares to enhance their efficiency.

Our nice benefit find shares that meet all 3 of those standards is our proprietary POWR Rankings mannequin analyst 118 elements for each inventory pointing to its seemingly outperformance within the yr forward.

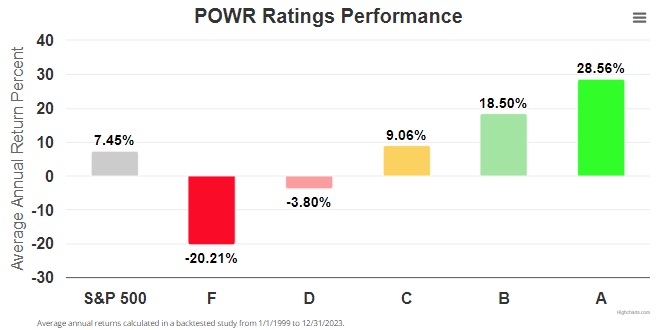

Sure, previous efficiency shouldn’t be a assure of future outcomes, however when you think about the constant outperformance of the POWR Rankings the previous 25 years, it definitely improves your odds in utilizing it as you progress ahead:

Your eye’s don’t deceive you. The A rated shares have topped the S&P 500 by practically 4X going again to 1999. And that outperformance continues to roll right here in 2024.

The draw back of this mannequin is that day-after-day there are roughly 1,300 purchase rated shares to contemplate. If you need me to slender that right down to my favourite 12 presently, then learn on under for extra particulars…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This contains 5 underneath the radar small caps lately added with super upside potential.

Plus I’ve 1 particular ETF that’s extremely nicely positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 44 years of investing expertise seeing bull markets…bear markets…and all the pieces between.

In case you are curious to study extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares had been buying and selling at $518.48 per share on Tuesday afternoon, down $3.68 (-0.70%). 12 months-to-date, SPY has gained 9.42%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Stock Q1 Recap & Future Outlook appeared first on StockNews.com